I think we can all agree; finding a new POS system is hard graft.

The stats speak for themselves; 23% of entrepreneurs aren’t satisfied with their POS system- that’s almost as much as a quarter of business owners!

There are so many options out there, but the two that come up time and again are; Clover and Square. After all, they’re both industry leaders and boast an excellent reputation.

This begs the tricky question; which is better?

Luckily for you, we’re going to cover exactly that here in this review. Continue reading to find out more!

Square vs Clover- Managing Your Business on the Go

Whether you opt for Square or Clover, you can manage your business on the go. This is because they’re both cloud-based systems, so you’re not confined to a specific location. This is amazing for entrepreneurs who need to operate on different sites or for those who travel a lot.

You can use Square’s Mobile Card Reader virtually anywhere!

- Predictable flat-rate pricing

- Ideal for low-volume merchants

- No monthly fees

- Impressive feature set

- Account stability issues

- Not suitable for high-risk industries

Plug this into the headphone jack of a smartphone, and you’re good to go. You can use this same mobile card reader alongside Square’s Stand POS (more on that later).

As you might expect, this mobile card reader is somewhat basic. So, it doesn’t offer much beyond taking card payments.

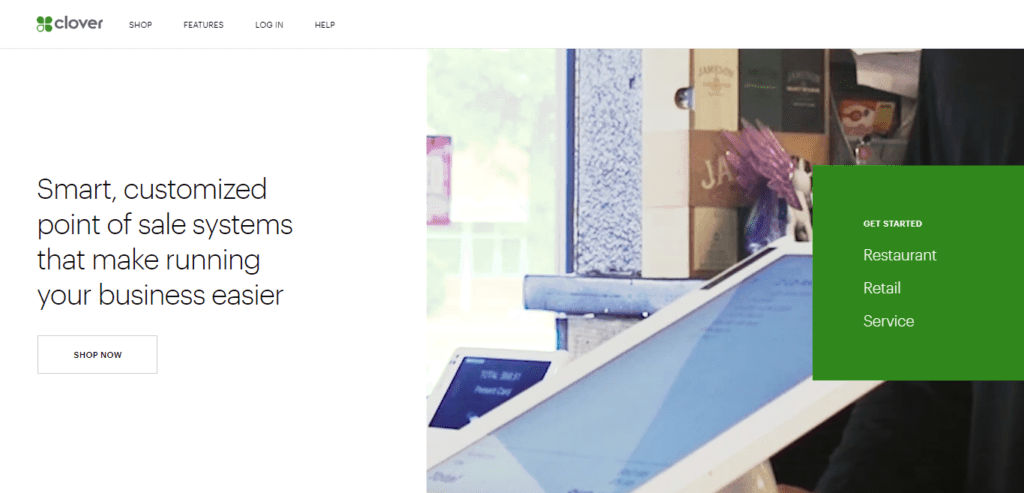

Whereas, Clover Mobile is far more sophisticated. Not only does it complement Clover Station (again, more on this later), but it’s also a fully-functioning POS system- which makes it ideal for restaurant owners.

- Delivery Management

- Gift Card Management

- Loyalty Program

- Mobile Access

- Suddenly offline

- Several charges

- Uncomfortable

What does it do?

Well it can:

- Take customized orders,

- Send receipts to the kitchen,

- Accept card payments,

All from the convenience of one device- how awesome is that?!

Square vs Clover- Compatibility

The compatibility of hardware and software are enormous factors when it comes to choosing a POS system. So, this might seal the deal for you.

Square’s Credit Card Processors:

If you’re using Square’s hardware, you can only use Square’s credit card processor. For some people, this is a nightmare.

On the whole, you’ll pay an average of 2.75% of the cost of each transaction (in credit card fees).

Clover’s Credit Card Processors:

Whereas, Clover’s a standalone POS system.

As such, you’re free to shop around to find the best credit card processor for you. There’s a good chance you’ll see a better deal than the 2.75%, we just referred to- which could potentially save you tons of money in the long run.

Square vs Clover- Functionality

Clover and Square both offer the below functions:

- The ability to take payments from either credit or debit cards,

- Provide customer receipts,

- Give the consumer the option of adding a tip,

Outside these core features, the functionality of these services depend on:

- The equipment you opt for,

- The payment plan you choose,

- The apps you download,

Unsurprisingly, if all you want is a mobile reader- you’ll have fewer features to work with. Whereas, if you need a full POS System, you’ll enjoy a significant number of benefits. Make sense?

This applies to both Clover and Square!

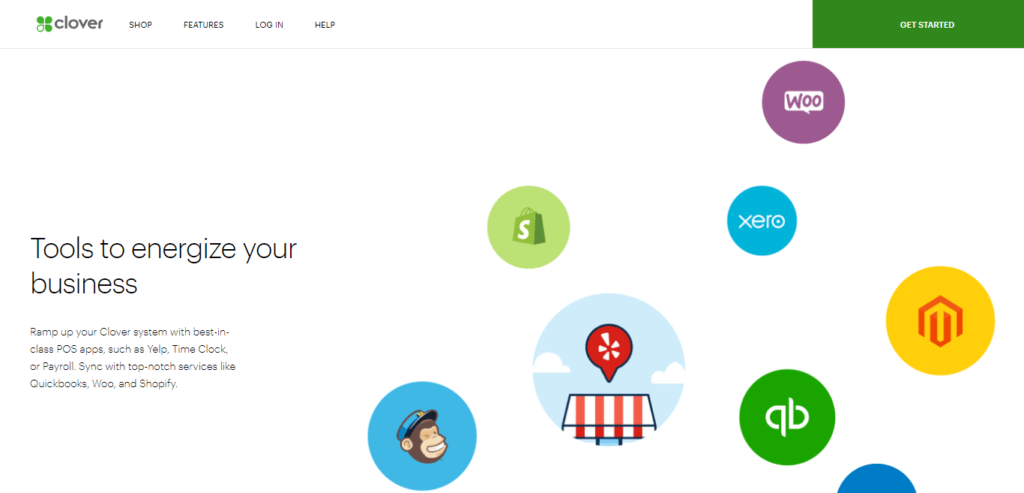

When you become a Clover user, you can access their App market. Here you’ll find hundreds of third-party apps. These enable you to customize their platform to suit the exact needs of your business.

Some of their more popular apps include:

- Their QuickBooks integration,

- Payroll services,

- Gift card programs,

Top Tip: If you’re not selling gift cards, you should be. Statistics show half of customers given a gift card spend more than the card ’s worth. This means more profit for you!

Like Clover, Square offers a selection of apps to boost the overall functionality of their software. Yet, their choice isn’t as extensive in comparison.

You should note: as with most programs, third-party apps sometimes involve extra fees. So, don’t forget this while calculating your budget!

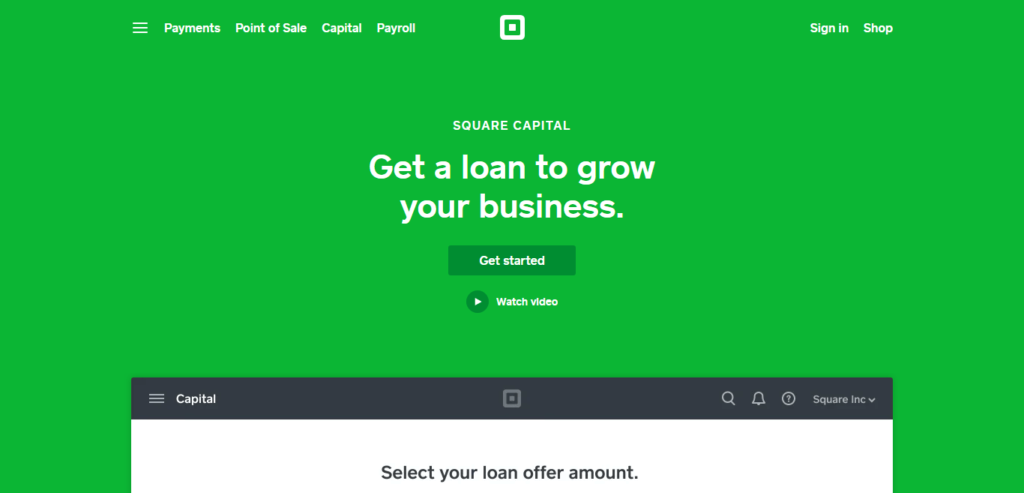

Square vs Clover- Cash Advances

In short, Square Capital gives users the option of taking a cash advance. Clover also offers a similar service, called ‘Clover Capital.’

How does this work?

Well, a cash advance is a bit like a business loan. Yet, there isn’t a fixed monthly repayment, and there isn’t a set interest rate. Instead, you’ll repay what you’ve borrowed as well as an additional fee.

Your repayments are paid automatically by taking a small part of your credit card sales. Therefore, the more you sell, the more you’ll pay off your cash advance- get it?

Although a cash advance is easier to get and maintain than a business loan, they usually cost more. So, it’s a good idea to study the pros and cons of using a service like this before signing the dotted line!

Square vs Clover- Customer Service

If customer service is essential to you, Square might disappoint.

Why?

You can’t access a telephone number for customer service until you’re a paid customer. Not to mention, lots of users have complained about their accounts being frozen or closed.

When this occurs, they’re provided with next to no support. You need a customer code, which can only be retrieved via your Square account- which due to the freezing or cancellation, you can’t access!

You should also note, their telephone support is only available Monday to Friday 6 AM-6 PM Pacific time. So, if you need assistance over the weekend, you’ll have to wait until Monday! They say email support is open 24/7- however, there’s a good chance you won’t receive an immediate response.

Last but not least, Square also encourages customers to reach out to them via Twitter. This is typically a slow and challenging process which customers are always complaining about!

However, Square’s self-help knowledgebase and its community forum are both fabulous resources. You’ll find tons of tutorials, answers to FAQs, and other troubleshooting info that should help you solve your own query.

Despite all that said about Square, you can’t be sure of excellent customer service from Clover.

Like we’ve already said, Clover’s formed of lots of different companies. So, it’s hard for Clover to account for the majority of customer service provided to its users. Some companies offer excellent service- whereas others, not so much.

However, if it’s technical support you’re after, you’ll be directed to First Data. They’re able to provide 24/7 support to their consumers via the telephone, email, or their self-service knowledge base.

Remember:

Merchants using Clover deal with the credit card processing company they’ve opted for. So, when you’re deciding, do some research and get a feel for the quality of their customer service.

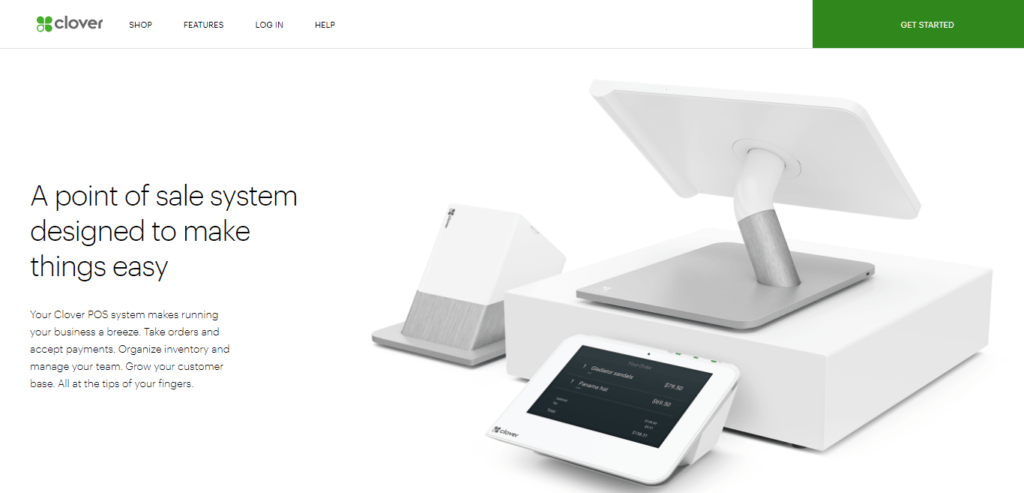

Hardware

Both Square and Clover offer a variety of hardware, here’s a quick rundown:

- Clover Go: Connect this device to your smartphone or tablet using Bluetooth. You can process payments using magstripe cards, chip cards, that’s in addition to taking contactless payments.

- Clover Flex: This is a handheld device that connects to WiFi. It accepts all the same payment methods as Clover Go. Plus, you can also save customer signatures, scan barcodes, and print receipts.

- Clover Mini: It’s virtually the same as Clover Flex. However, its designed to sit on your countertop rather than to be used as a handheld device.

- Clover Station: This is their most sophisticated piece of POS hardware. It’s a countertop payment processor which comes with a cash drawer. Plus, from its screen, you can access all Clover’s business-management tools.

It doesn’t matter whether you need these devices to work alone or in conjunction with one another; it’s up to you. Assess the needs of your brand and respond accordingly.

Like Square, Clover also offers a host of hardware for you to buy and make use of.

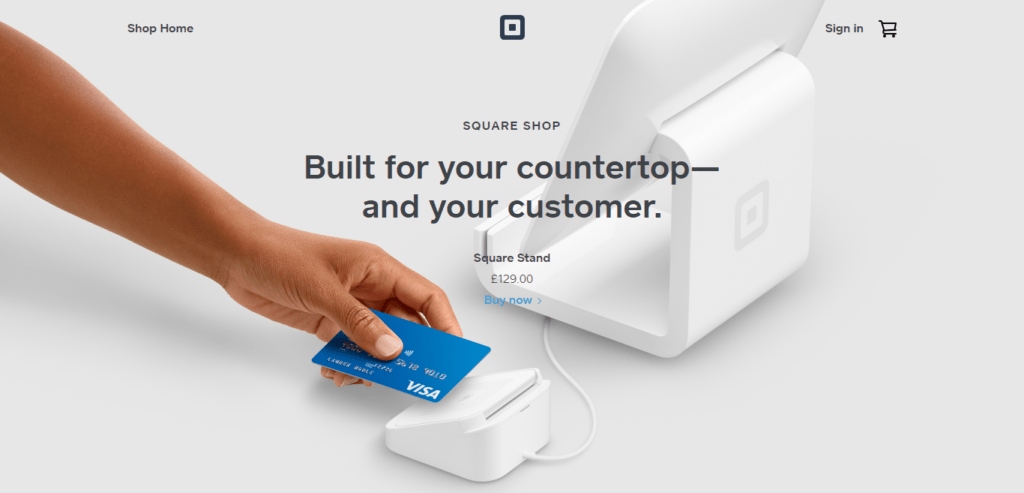

So, here it is-

- Square Register: This is Square’s most potent POS hardware. It’s a countertop payment processing system including customer-facing display. You can accept magstripe cards, chip cards, and contactless payments. Plus, the Square POS app is already ingrained into the Square Register!

- Square Terminal: This is a more compact POS terminal. You can accept and process the same payment methods as Square Register. Plus, using a USB port, you can connect to either Ethernet or WiFi.

- Square Stand for Contactless and Chip: This is a stand which you can connect your iPad to. Then download the Square POS app, and voila, you have a fabulous POS system functioning via your iPad.

- Square Card Readers: Square offers plenty of card readers. Including chip-card, magstripe-card reader, or a contactless payment reader.

Now, let’s explore a more in-depth comparison of the hardware that most closely matches each device provided by Square and Clover:

Clover Go vs Square Mobile Readers

Square’s well-renown for their small credit card readers. These accept card payments using just a smartphone. Clover Go offers similar functions with NFC capabilities.

However, Square doesn’t offer a combination reader that includes- magstripe /EMV / NFC to be used with a smartphone. If this is something you need, you’ll have to use their magstripe reader and their EMV/NFC combo reader- which means two devices rather than one!

Whereas, Clover offers its customers a more convenient all-in-one card reader. This enables entrepreneurs to take:

- Magstripe cards,

- Chip cards,

- Contactless payments

All with the same device!

You can also enjoy all the following features from both these solutions:

- You can key in transactions manually,

- Add tax,

- Offer discounts,

- Give the option of adding a gratuity,

- Collect signatures,

- Email or print customer receipts.

Clover Flex vs Square Terminal

Both devices are compact and lightweight. However, Clover Flex is slightly smaller with a 5” touchscreen (instead of a keypad) and it weighs just one pound.

Whereas, despite the terminal touchscreen measuring a larger 5.5” (again in lieu of keypad) it weighs under one pound.

Both include built-in printers, which is amazing if your customers require physical receipts. However, Clover Flex also includes a built-in barcode scanner, which is something Square’s Terminal lacks.

On the other hand, if you don’t need to scan barcodes, you might be better off with Square. After all, the design’s a little sleeker, and the hardware is cheaper- what’s not to love about that?!

Clover Mini vs Square Stand

Throughout this review we’ve referred to both the Square Stand and the Clover Mini as POS systems; however, they’re more like miniature versions of a fully-fledged POS- yet, they’re not portable.

You should note: One of the great things about Clover Mini is that you can mount it to a wall, which provides a unique alternative to the counter.

In the table below you’ll see the main similarities and differences between the Clover Mini and the Square Stand:

Software Plans

How do you make the most out of Clover’s hardware?

Answer: you need to purchase one of their software plans.

The one you opt for will depend on the number of credit card payments your process annually. So, have that info to hand as you peruse your options.

You’ll also need to take into consideration any extra features you want access to.

So, here’s a quick list of Clover’s software plans:

- Payments Plus: This is Clover’s most basic plan (and it doesn’t cost you any extra). With Payment Plus you can accept cloud-based payments. You’ll also have access to basic customer engagement tasks.

- Register Lite: This plan is ideal for brands turning over $50,000 each year in credit card payments. You can also use plenty of tools to help you track your sales.

- Register: This is the most extensive software plan, and it’s best for companies processing more than $50,000 per year in credit card sales.

When it comes to Square’s software, it’s far simpler because you can access their core POS program for free, which also include real-time analytics and PCI compliance.

Pricing

You’re probably wondering; ‘how much will Clover set me back?’

So, as you may have already guessed, you can mix and match Clover’s hardware and software to create a solution that works for you.

Here’s a quick break down of the costs involved:

- Clover Go: $59

- Clover Flex: $449

- Clover Mini: $599 (starting from)

- Clover Station for full-service restaurants: $999,

- Clover Station for full-service restaurants plus dining software: $1,068

- Clover Station for other businesses: $1,199 (starting from)

- Register Lite: $14 (each month)

- Register: $29 (each month)

The best thing about Square?

Square’s POS app is absolutely free. However, you’ll need to buy the necessary hardware to get it to work. That’s except for the Square magstripe reader, (which you’ll also get free).

The price of Square’s equipment is as follows:

- Square Register: $999

- Square Stand: $169

- Square Terminal: $399

- Square Contactless and Chip Reader: $49

- Square Chip and Magstripe Reader: $35

However, the way their card payment rates are broken down is somewhat more complicated. Check out the table below to get a better idea of what we mean:

Square vs Square- Popularity

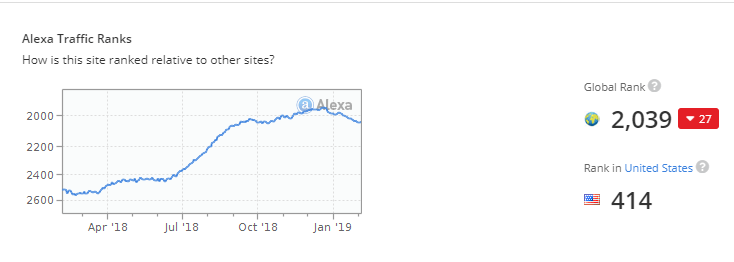

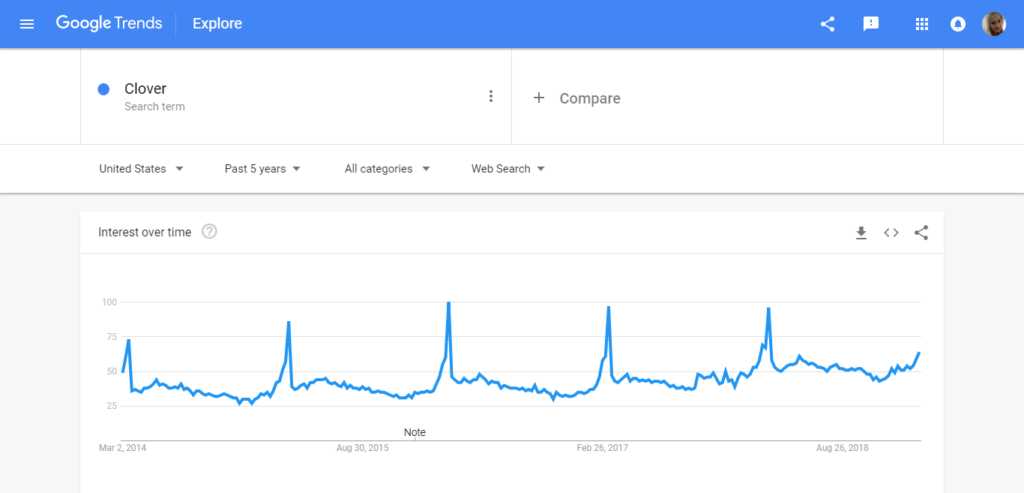

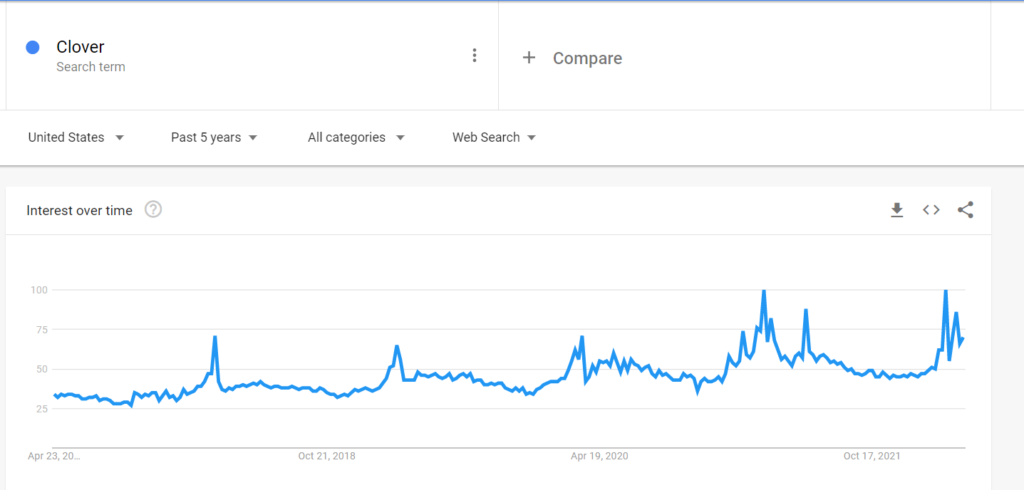

Using Google trends and Alexa’s traffic data, we get a feel for the popularity of each software.

Here you see a slight rise in Square’s popularity over the last five years.

The same is true with Alexa’s traffic results.

In the screenshot below, you see Clover’s popularity has remained pretty static.

However, there’s a stark rise in people searching for Clover using Alexa.

Square vs Clover- Their Mobile App

This is best compared using a table, so take a look at each of the features offered by Square and Clover’s apps:

Advertising Transparency

Square is incredibly transparent. Over on their website, you’ll find out everything you need to know about:

- Contract terms

- Pricing info

- Details on how to upgrade or change plans.

There’s a good chance you won’t have to deal with aggressive salespeople or misleading ads.

There are plenty of reviews complaining about the credit card processors Clover’s associated with. Some of these have a habit of publishing misleading pricing and using unethical sale practices.

The Pros and Cons of Using Clover

The Pros and Cons of Using Square

Frequently Asked Questions

Is Square better than Clover?

Clover is better than Square. Square: 4.7 out of 5, Clover: 4 out of 5.

Is Clover the same as Square?

They are both cloud-based systems. However, Clover is seen as being far more sophisticated. It is a fully-functioning POS system, which is ideal for restaurant owners. It can take customized orders, send receipts to the kitchen and accept card payments.

Is Clover cheaper than Square?

Clover is the cheaper version. Clover Go: $59 dollars. Clover Flex: $499 dollars. Clover Mini: $599, to name a few. Square Register: $999 dollars. Square Stand: 169$ Square Terminal: $399. Square Contactless and Chip Reader: 49$.

Is there a monthly fee for Clover?

Payments Plus-4.95$ a month. Register Lite Plan: 9.95$ a month. Register Plan: 29.95$ a month.

Which is best Clover or Square?

Clover is the best cloud-based POS system because it is much more sophisticated than Square. Moreover, Clover provides a wide range of POS functions that streamline critical functions in a restaurant.

How is Clover different from Square?

Clover is cheaper than Square and provides much more options in terms of POS functions, customized packages, and payment options.

What percentage does Clover take?

Clover charges 2.3% plus 10 cents for in-person transactions and 3.5% plus 10 cents for online payments.

Final Thoughts: Clover vs Square

As you can see, Clover and Square boast very similar features.

So, what’s the verdict?

Clover is usually a better choice for brands who not only want a POS system but also need software to help manage their business.

It doesn’t matter whether you’re running a:

- Traditional retail store,

- A restaurant,

- A service-based business,

You’ll find Clover offers a handy solution to meet the needs of your industry.

Whereas, Square is much better suited to anyone needing a no-frills POS solution. If all you need is to accept and process a variety of payment methods, Square’s a great choice!

All in all, you need to have a good think about what you want from your POS system. Then see what you can get for your budget. With all that being said, both these programs are excellent, so you shouldn’t go too far wrong with either.

Have you got any experience using either Clover or Square? Write a comment in the box below and kickstart the conversation!

I'd always want to be update on new content on this web site, saved to fav!