You may have heard about TransferWise as a safe and inexpensive alternative for making international money transfers, but I’m guessing you may not be familiar with the details of TransferWise’s Borderless account.

And have I got news for you: if you’re looking for a safe, convenient and inexpensive way to make multiple international money transfers at any given moment, you can’t do much better than setting up a TransferWise Borderless account.

- No Hidden Fees

- Multi-Currency Account

- Simple Registration and Processing

- Both for Personal and Business use

- Business transactions not supported for a few countries

- Debit Card not available in all countries

Here’s why:

TransferWise Borderless Account Fees

I get it – you’re sick to death of being nickeled and dimed by expensive transfer and account fees.

Well, guess what? You won’t have to worry about endless hidden fees and other expenses when it comes to transferring money internationally through your TransferWise Borderless account.

Think of your Borderless account like a virtual account that holds your money in multiple currencies all at the same time. When you need to send money somewhere, you can do so at the real exchange rate for that location in whatever currency you need.

And the best part: The real exchange rate is a transparent fee that you can check against multiple public sources so that you always know you’re being charged a fair rate.

And get this: when compared to other bank accounts across the world, TransferWise has consistently emerged as the cheaper option for international money transfers by several independent ratings agencies, including Consumer Intelligence.

But be careful: inexpensive doesn’t mean free. TransferWise does still charge some fees, including fees to convert between currencies in your account; to send or withdraw money; or to add money to your account.

But the good news: these fees are all transparent, which means they aren’t sneaked into other activities, so you can always check them against the TransferWise price checker.

If you have a debit card associated with your TransferWise Borderless account, you also may pay some fees associated with using your card.

Time to Transfer

How long does your transfer take? Well, that depends on a few things, including the amount of currency that needs to be exchanged and its ultimate destination.

For example, transfers within the same country/currency can sometimes be completed in a matter of minutes because there’s no currency exchange involved.

But others, with complicated conversions and high dollar amounts can take as much as a week to complete.

Why? Because multiple banks may be involved, which means your overall time to transfer depends on how quickly they can process the transaction.

And here’s something else: the way you pay for your money transfer also affects how long it will take.

For example, if you pay with a credit card, your transaction will go through a lot more quickly than if you use a bank transfer, which can take a few days to fully process.

What else affects the timing of your transfer? The time you make your transfer may be a factor – transfers are only processed during regular business hours.

And if TransferWise needs to do any additional verification of your I.D. for security reasons, that process also can add some time.

But here’s the deal: You’ll never be in the dark about when your transfer will reach its ultimate destination.

When you’re using the TransferWise website or app, you can see how long your transfer will take – even before paying for it.

And the best part? You’ll get status updates all along the way, so you’ll always know exactly where your transfer is in the overall process.

Pros and Cons

What are the pros of TransferWise?

First there’s the convenience – sending and receiving international money transfers is incredibly fast and easy once your TransferWise account is set up, and the user-friendly app is just an added bonus.

The customer service support is also unparalleled. Plus there’s the fact that there are no hidden fees and you can always check against public sources to make sure you’re getting the real exchange rate at any time.

In fact, the greatest benefit of using TransferWise is the ability to transfer money when and where you need it without paying outrageous or hidden fees.

Almost any TransferWise Borderless account review you can find will sing the praises of the low and transparent fees.

TransferWise can’t be perfect, right? What about the cons? There are a few.

First of all, a Transferwise Borderless account isn’t available everywhere. And because you can’t really use your Borderless account as a bank account, you’re also limited as to actions you can take with your money.

Also keep this in mind: if you’re based in the United States, customer service is only available during regular business hours, so you won’t be able to get support if you’re setting up a transfer outside of a regular workday.

And finally? You do have to abide by transaction limits in some cases.

How Do I Get a Borderless Account?

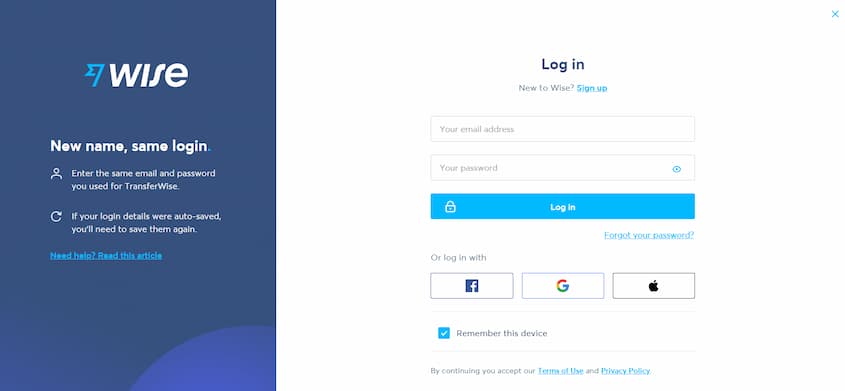

You can quickly and easily set up a TransferWise Borderless account through the TransferWise website or through the TransferWise app – all you need is an email address and to choose a password for your account.

TransferWise will verify your identity, and then you can activate your account.

To help verify your identity, you can upload a photo of your driver’s license or passport, plus a current utility bill or other related document that shows your current address.

Next step? You simply log into your new account, click the Balances menu option, select Add a Balance and add your desired amount in the currency of your choice.

Voila! I told you it was easy. And here’s something else to consider: if you’re a customer residing in Europe, when you set up your account, it’s also easy to go ahead and sign up for TransferWise’s MasterCard debit card.

Is TransferWise Safe?

How safe is TransferWise? Well, let’s first take a look at the various entities that regulate its business.

First there’s the Financial Conduct Authority, plus Her Majesty’s Revenue and Customs, both of which regulate TransferWise within the United Kingdom, where its corporate headquarters are located.

TransferWise also is an Authorized Electronic Money Institution, and since it operates in multiple countries, it also is subject to regulation within the countries it serves.

And here’s something else: TransferWise will keep your money separate from its corporate funds, which means that if anything goes amiss with the company, your money remains safe.

In addition, TransferWise always uses trusted local banks to actually hold your money and verifies the identity of those who use its services in order to guard against fraud and money laundering.

What about the tech side? If you’re worried about someone easily hacking into your information, rest assured.

TransferWise also uses industry-leading security for its services, including two-step verification and login procedures, plus HTTPS encryption.

Check out Transferwise Borderless account reviews online if you’re curious about how these safety measures hold up.

TransferWise Borderless Countries

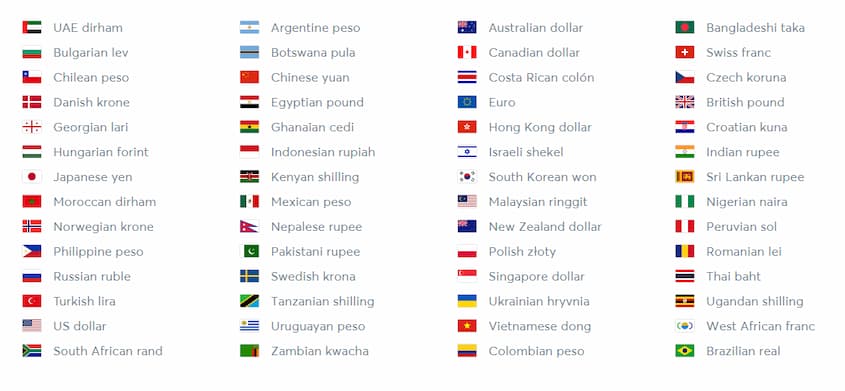

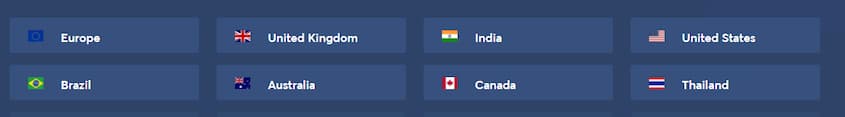

The TransferWise Borderless account is available in many countries, though some partnership limitations prevent it from doing business everywhere.

There are a few countries in Africa and Asia that don’t make TransferWise available, along with U.S. states like Nevada and Hawaii.

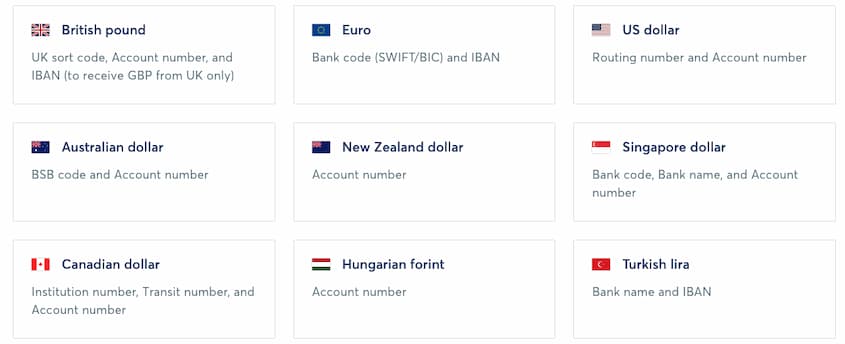

Right now, you can access local account details in U.S. dollars, British pounds, Euros, New Zealand dollars and Australian dollars.

FAQs

How does a TransferWise Borderless account work?

It’s simple – every Borderless account TransferWise manages is a multi-currency account, so you can receive, hold, send and spend money in more than 50 currencies. Plus you can convert among those currencies at any time.

Can I use TransferWise as a bank account?

Well, that all depends on how you define “use.” Keep in mind that your TransferWise Borderless account is really an electronic money account, which means that it simply provides an “address” that you can use for sending and receiving money. What does that mean for you? It means you can use your TransferWise Borderless account much like a traditional bank account when it comes to sending and receiving money. But – unlike a traditional bank account, your TransferWise Borderless account won’t allow you to incur an overdraft or apply for a loan, and the money stored here won’t earn any interest. You don’t have the option to open a savings account, and your TransferWise Borderless account won’t include any tools to help you reach savings and investment goals, budgets, etc.

Is TransferWise considered a foreign bank account?

“Foreign” is relative, right? Keep in mind that TransferWise is headquartered in the United Kingdom, so in the UK it certainly isn’t considered foreign. However, if you’re a U.S.-based account user, TransferWise is considered a foreign financial entity for U.S. citizens and residents.

Updated name

Effective February 2021, TransferWise has changed its name to Wise – and with this name change comes an adjustment to the Borderless account, which is now known as Wise’s multi-currency account.

Conclusion

Overall, TransferWise is a safe, inexpensive, reputable and reliable way to make international money transfers.

Since the company was founded in 2011, it has made it possible for more than five billion customers to move currency safely around the world.

Check it out today if you’re looking for the best way to send money internationally – you won’t be sorry!