Let’s face it: when it comes to making an international wire transfer, the process can be time-consuming, frustrating and expensive. But the good news?

With Transferwise, you can remove much of the pain associated with quickly getting money into the hands of family or friends who need it.

So if you’re pondering how to send money internationally, there are a few key areas about Transferwise you should consider.

- No Hidden Fees

- Multi-Currency Account

- Simple Registration and Processing

- Both for Personal and Business use

- Business transactions not supported for a few countries

- Debit Card not available in all countries

Now I’ll walk you through these areas and everything you need to know about each one.

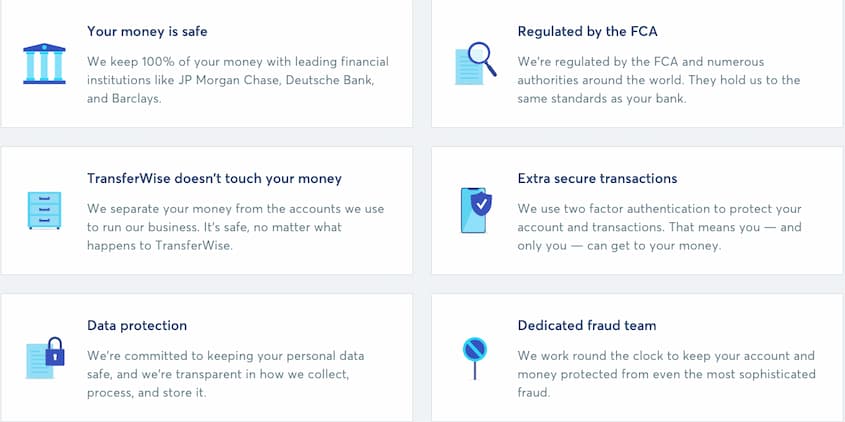

Is Transferwise Safe?

I know – you’re worried about how to send money internationally in a way that’s secure. Is Transferwise safe and legit?

Yes. You can rest assured that Transferwise is fully authorized and licensed, and comes highly recommended by millions of customers. In fact, Transferwise is an Authorized Electronic Money Institution.

So what, you ask? That means Transferwise is regulated by the Financial Conduct Authority and Her Majesty’s Revenue and Customs in the United Kingdom, where it’s headquartered, and it’s also closely regulated by regulatory bodies in other countries in which it does business, so Transferwise frauds are highly unlikely.

How safe is Transferwise? Transferwise also takes additional voluntary safety precautions, such as two-step verification and login procedures.

Transferwise prides itself on its strong, industry-standard HTTPS encryption that protects and secures every single transaction. And per FCA requirements, client funds are held separately from business funds, so if Transferwise suffers a financial catastrophe, the money you’ve entrusted them with remains safe.

Still not convinced? With Transferwise, you can use several different options to pay for your international wire transfer, all of which should give you peace of mind.

For example, you can use ACH, SWIFT or wire transfer through your bank account, but if that makes you nervous, you also can make your transfer through a credit card, Apple Pay or Google Pay. And you know what else? You also can rest assured knowing that Transferwise is highly reputable and that more than seven million customers trust it.

Transferwise Fees

So, will Transferwise charge you a lot of hidden fees? The answer is no. Instead of charging you any hidden fee, Transferwise takes a small percentage of each wire transfer you make, and in some cases may charge a flat, transparent fee, depending on the specific transfer route.

What does that mean for you? With this model, that means no hidden bank fees or transfer fees, which can sometimes be as much as 20 percent of your international wire transfer amount.

And there are no secret fees bundled into your exchange rate, either. Plus – there are no Transferwise fees for receiving money.

And the best part? You’re not charged any fees for transfers you make in your local currency – you’re only charged fees associated with exchanging your transfer funds from one currency to another.

The only debit card fees Transferwise charges is for ATM withdrawals over $250 or if you exceed two ATM withdrawals per month.

Here’s what’s important, though, to keep in mind: your Transferwise cost often isn’t the only fee source involved in your transaction.

For example, if you’re making your transfer by credit card, you may be charged a fee from the credit card company ranging from .3-2 percent, depending on the specific currency and type of credit card involved.

Bottom line: it’s also important to check with your bank to see if it will charge you fees associated with ACH or SWIFT transfers.

Transferwise Exchange Rate

With Transferwise, you can rest assured knowing that you’re always going to be charged the mid-range exchange rate for making your international wire transfer.

What does that mean for you? It means you’re not paying hidden fees disguised as part of the exchange rate.

With some other vendors, you may see big fluctuations in currency exchange rates – that’s because these services are building in fees and translating them to you as part of the exchange rate.

You never have to worry about that with Transferwise.

Instead, Transferwise uses real currency exchange rates – the mid-range rate is equal to the midpoint between the buy and sell rates in the global currency market. Why does this matter?

Because it’s fair – and it’s public. You can always check your Transferwise rate against rates published by Google, Yahoo, Reuters and more.

So you can be sure you’re getting a fair rate – in fact, it’s the fairest rate you could ever dream of.

And you know what else? With Transferwise’s handy pricing tool, you can see exactly how much you’ll pay to transfer the amount of money you want – before you make your transfer. Check the latest exchange rates here.

The Transferwise Borderless Account

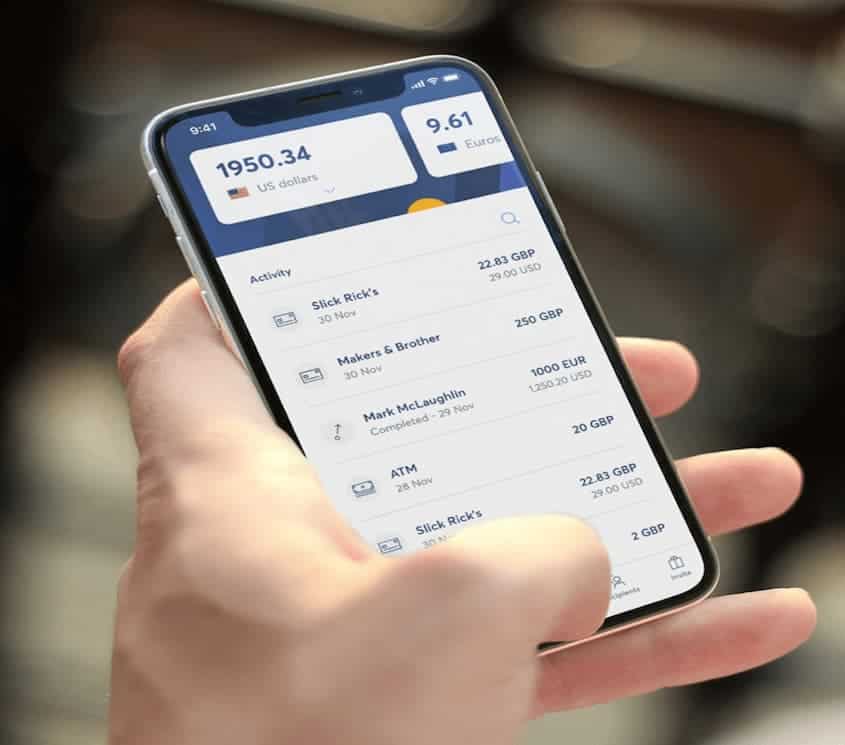

The Transferwise Borderless bank account is a multi-currency account that allows customers to hold funds in more than 40 different currencies.

These funds can then be converted at the mid-range exchange rate and transferred around the world quickly and easily.

Why does that matter? Think about it like a one-stop virtual bank account that holds lets you essentially have local bank accounts all over the world.

Your first borderless bank account will be set up with your local currency, but you can open others with currency for other locations as you need them.

With this account, you also can receive funds from up to 30 different countries.

And people love this account – just about any Transferwise borderless account review you can find will sing its praises.

And get this: there are no setup fees, no monthly charges and no fees to send or receive payments as long as they remain in local currency. How’s that for a deal?

How Does Transferwise Work?

How does it work? Easy peasy, that’s how. To use Transferwise, you simply use your Transferwise Borderless account to make an international money transfer to Transferwise.

You can set up that account in a jiffy on the Transferware website – you have the option to register with an email address, or to use your Google, Facebook or Apple account to access.

Using the Transferwise website or app, select which countries you’re sending money to, choose how much, and enter the information for the beneficiary. You’ll choose how you want to pay for your international wire transfer – bank account, credit or debit card, Apple Pay, etc.

Once funds are received, the team at Transferwise exchanges the currency on your behalf – this is a transparent process, so you can track its progress through the Transferwise website.

Next steps are simple: after the exchange is complete, Transferwise makes a local deposit according to the beneficiary info you’ve provided.

One key point to remember: the person receiving money on the other end must have a bank account so that Transferwise can make a direct deposit. The recipient will not be able to pick up cash.

The bottom line? You easily make your wire transfer in your currency, and your recipient receives a deposit in the currency of her country.

Transferwise currently offers money transfer services to send money internationally from 43 different countries, with 71 different destination countries. It really can’t be any easier to send money internationally.

Transferwise Debit Card

Transferwise also offers customers a multi-currency debit card, which is linked to your borderless account.

At the time of this writing, the Transferwise debit card was available for customers in Europe only. And while I know you want a Transferwise credit card, that item doesn’t yet exist.

Let’s hope for the future!

How Transferwise Compares to Other Options

If you’re not ready to jump on the Transferwise bandwagon, there are other options out there.

Just keep in mind that most other options include those pesky hidden fees, whereas with Transferwise, the fees are low and transparent, and they’re never rolled into your exchange rates.

Transferwise vs. Xoom

For example, many people like to use Xoom, especially if they’re looking for their beneficiary to be able to pick up cash, but unlike Transferwise, Xoom marks up its exchange rates and often adds other fees.

Ofx vs. Transferwise

Ofx is another option, but it’s typically more expensive than Transferwise when you’re making transfers of $7K USD or below.

Transferwise Pros and Cons

It might go without saying at this point, but Transferwise offers a number of pros:

great pricing, transparent fees, high security and ease of use, amazing customer satisfaction and the ability to transfer money when and where you need it, quickly and easily.

The only cons I can see are related to the fact that Transferwise isn’t yet available for international money transfers everywhere and the fact that your recipient can’t pick up cash – plus the fact that Transferwise might not be the best option if you’re making frequent large wire transfers.

Transferwise – Now Wise

Effective in February 2021, Transferwise changed its name to Wise to better reflect the financial services it offers outside of international money transfers.

According to the company, this will be a seamless transition for customers, with the renaming of all Transferwise apps and the transfer of information from transferwise.com to wise.com.

But the mission of the company remains the same – making money work without borders.

FAQs

Is Transferwise Better Than a Bank?

That depends on how you define “better,” but I can tell you that Transferwise has been shown to cost up to eight times less than going through a bank to make an international transfer. Some might even argue that Transferwise is the best way to send money internationally. Transferwise offers a good, comprehensive domestic and international wire transfer service that’s fair and can save you money over the long term because of the upfront and transparent fee structure. Why? Because unlike most banks, Transferwise doesn’t charge an exchange-rate markup on any international wire transfer.

How Does Transferwise Work?

The Transferwise process is simple. Just visit the Transferwise website or download the Transferwise app to get started – you’ll find a pricing calculator right on the home screen that can help you figure out how much it will cost to transfer your amount. Your rate is guaranteed, and you can cancel any transfer in process before it goes through.

What is Transferwise?

Transferwise is a domestic and international wire transfer service that can help you wire money to friends and family in need. With a goal of enabling money transfers at a significantly lower rate than banks, Transferwise charges low and transparent fees and also exchanges money at the true mid-market exchange rate, with zero markup. With this kind of business model, Transferwise has made a name for itself as a powerful disruptor of the traditional money transfer model.

How do I use Transferwise?

Transferwise makes transferring money a smooth and easy user experience, with an intuitive website and app, plus amazing customer service, which you can access through email, live chat or phone. And you can do it all easily via your mobile phone or desktop.

What’s the Cheapest Way to Send Money Internationally?

Because of its focus on low, transparent fees, Transferwise is often the cheapest way to send money internationally, but it really depends on the specific circumstances. When is Transferwise the best way to send money internationally? I’d say when you’re transferring relatively small amounts of money between countries currently served by Transferwise. If you’re regularly transferring larger amounts – like more than $7K USD – or want to send money internationally to a country Transferwise doesn’t serve, you may be better off with a different money transfer partner.

Conclusion

Transferwise offers a quick, user-friendly and inexpensive way to get money fast to the people who need it in the currency they need.

Check it out today so that you don’t waste money on markups and tricky exchange rates – with Transferwise, you’re getting a safe, reliable, transparent and inexpensive way to make an international wire transfer.