Is Skrill safe, or is it a scam?

If you regularly buy and sell products online, particularly with cryptocurrency, you’ve probably heard of Skrill. While many reviewers seem to be happy with their service, there are also a lot of posts out there about Skrill scams.

So, is Skrill legitimate? Or is it a scam?

I’ve done my research. I’ve scoured the net, and read a lot of good and a lot of bad, including some pretty frank remarks by a former Skrill developer. I’ve tried to cover all relevant points, so everything you need to know is right here.

What Is Skrill?

First, let me give you a quick overview of Skrill.

Skrill is an internet payment processor, similar to PayPal. When it was originally founded in the UK in 2001, it was called Moneybookers. Originally, the company focused on gambling and e-sports transactions.

Can you guess how much the company grew in just 8 years?

By 2009, Moneybookers was worth £365 million, and they announced that they would be offering services to all customers and business, not just gambling and e-sports.

In 2011, the company announced that they would be rebranding themselves as Skrill. To be honest, I could not find the exact reason for their rebranding.

In 2013, the newly-rebranded Skrill purchased paysafecard, an Australian prepaid card program, and was in turn acquired by CVC Capital Partners. In 2015, they merged with Neteller, one of their largest competitors.

So how many currencies can you use on Skrill?

Skrill currently accepts payments in over 40 world currencies. I was also amazed to learn that they also accept transactions in cryptocurrency.

It gets better.

Skrill issues a Skrill Prepaid Mastercard as a physical or virtual card. These cards can be issued in four currencies: British Pounds, US Dollars, Euros, and Polish Zloty.

Have you decided to set up a Skrill account? Click here. It takes just a few minutes.

- Credit Card Transactions

- Email transactions

- Free account

- Fast access

- One place data

- Time taking withdraw in bank

- Few Currencies transaction

Still want to dig deep? Let’s continue.

Is Skrill Legitimate?

Before we talk about Skrill’s features, let me tell you what I’ve learned about the company.

From the day it was founded, Skrill has been registered with the UK’s Financial Conduct Authority. Their stock is traded on the FTSE 250.

They also have a European e-Money license which allows them to operate everywhere in the world outside the US. In the US, they’re licensed in all 50 states.

Yes, Skrill is a legitimate business. But there’s more to learn.

So, what should you be concerned about?

A lot of Skrill’s reputation issues stem from the time when they were strictly a gambling payment processor. Gambling is a risky business, and even honest bookmakers will have angry customers.

I’m willing to give them a pass on bad reviews from their Moneybookers era.

Let’s look at what their current customers are saying.

Skrill currently has a lot of negative reviews from reputable sites. Cardpaymentoptions.com has given them a grade of C, and the Better Business Bureau has given them a grade of B.

So, who is leaving the negative reviews?

During my research, most of the customer-written Skrill reviews I’ve seen have been written in broken English, though, which leads us to believe that US and UK customers are mostly happy.

So what were the unhappy customers upset about?

I’ll go into this more when I talk about security, but I suspect that these complaints are related to Skrill’s obligation to verify their customers’ identity.

This is easier to do in Western countries, which may be a big part of their users’ problems.

While some customers were unhappy about Skrill’s identity verification procedures, I appreciate them. They keep their users safe by making sure people are who they say they are.

While some customers were unhappy about Skrill’s identity verification procedures, I appreciate them. They keep their users safe by making sure people are who they say they are.

Yes, absolutely, Skrill is a legitimate business. But before you sign up for Skrill, you may want to learn about their fees.

Want to start an online business with no money?

Follow this Step by Step Guide to Start a Shopify Print on Demand Business.

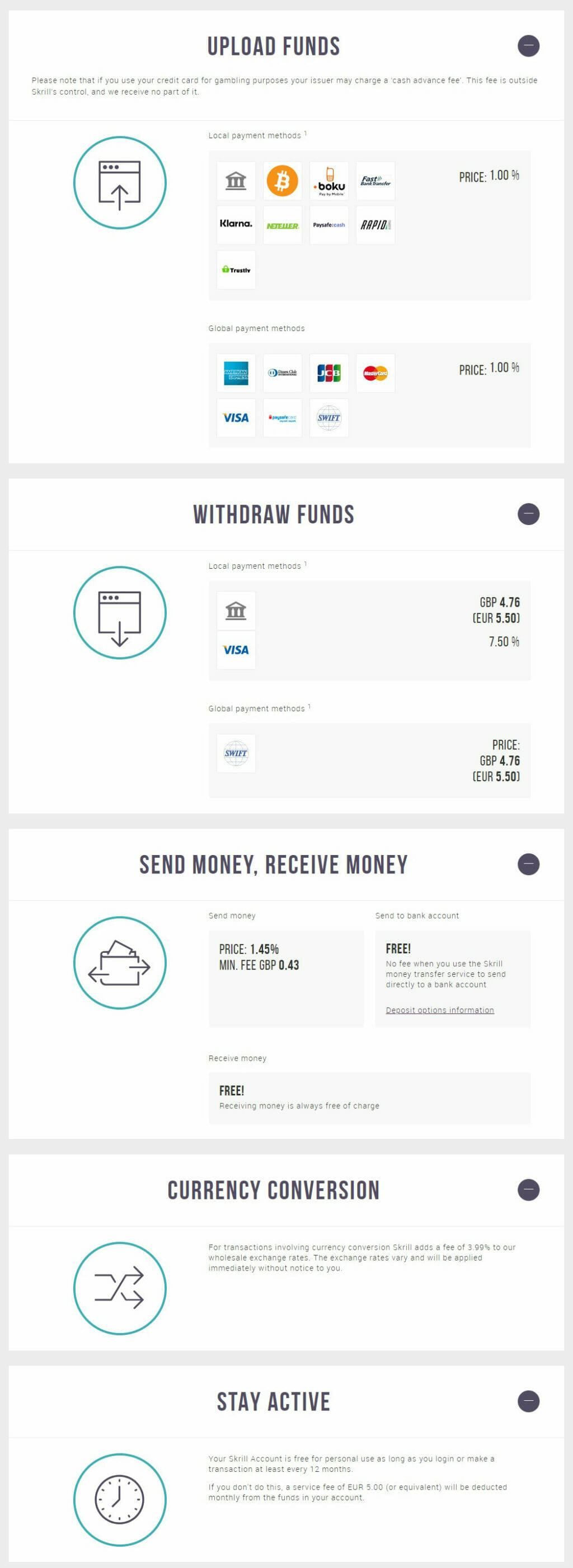

How High Are Skrill Fees?

Another common complaint is that Skrill fees are too high. Are they? Let’s take a look.

When I first looked into this, it seemed like a silly complaint. The transaction fee of sending money from Skrill to Skrill is 2.99% of the payment when the user is using the card. This is comparable to PayPal because it charges 2.9% of the payment plus an additional fixed fee that varies according to the currency

So why are people upset? Another complaint was their chargeback fees.

Chargeback fees on Skrill are €25, or about $28.36 as of February, 2019. That’s a bit high compared to PayPal’s $20 chargeback fee, but it’s not exactly highway robbery either. Like PayPal, they don’t charge for account setup or fraud protection, so you get that for free.

So where are these so-called high fees coming from? It looks like this is happening on withdrawals.

Skrill charges up to 3.99% of the withdrawal fee on Visa and MasterCard and €5.50 on the bank transfer. That’s a significant fee if you’re withdrawing a small amount of money. Even if you’re withdrawing large amounts, this is far more expensive than PayPal, which doesn’t charge anything for withdrawals.

What other fees does Skrill charge?

There’s a $0.55 charge on returns and a hefty €5 (currently $5.69) monthly charge on accounts that have been inactive for more than 12 months.

By now you’re probably asking yourself if it’s free to load funds. The answer is no.

There’s an additional fee for loading funds into your account unless you’re doing it from a checking account. These range from a 1% charge on Bitcoin deposits, up to 2.5% for deposits from a Paysafecard debit card, which is mystifying, since Paysafecard is part of the same company.

Finally, there’s a special service fee for merchants who pay less than €10 per month in transaction fees. There’s no information available on exactly how much that service fee is, but it may be substantial.

Let’s use a real world example to see how all this pans out.

Suppose you want to sell a guitar for $1,000. Out of that $1,000, you’ll pay the following fees:

Transaction fee – $19.29

Currency exchange fee (if applicable) – $39.90

Withdrawal fee – $5.69

Takeaway – $935.12

So you could end up paying $74.88 in fees. Compared to PayPal, that’s fairly high.

Sign up Skrill for free and create account. It takes just a few minutes to create a Skrill wallet and bring all your payment details together in one place.

Honestly, a lot of the frustration with Skrill seems to come from the fact that their rates aren’t transparent.

I had to look through several articles and reviews to get all the fee information, and even then, nobody seems to know how much the fee is for merchants who don’t get charged $11.34 per month. Except Skrill, and they’re not telling.

Of course, PayPal has its own issues, like being unavailable in several countries. Let’s look at more of Skrill’s features.

Sign up Skrill for free and create account. It takes just a few minutes to create a Skrill wallet and bring all your payment details together in one place.

What Countries Are Supported?

A better question would be, what countries aren’t supported?

Skrill is authorized to process payments to and from every country on Earth, except countries that have been sanctioned by the World Bank or the UN.

This puts them a cut above the competition, which likes to play it safe and stay in most developed countries.

How many people use Skrill?

I was amazed to learn that as of March 2022, Skrill had over 156,000 active merchants, and over 40 million active users.

I’m not saying it’s universally accepted – it’s not – but it’s accepted by a lot of people, including people who, for whatever reason, can’t use PayPal.

Here is the list of non-serviced countries:-

But what about safety?

Sign up Skrill for free and create account. It takes just a few minutes to create a Skrill wallet and bring all your payment details together in one place.

Is Skrill Safe & Secure?

Security is probably your biggest concern, so let’s take a look.

Because Skrill has to comply with US, UK and EU financial regulations, they have very strict standards for identity verification.

How does verification work?

As part of the verification process, users have to make a deposit with a bank account, debit card or Bitcoin. Generally, that’s sufficient for verification, but I’ve seen several stories about people being asked for photos of their government ID or bills sent to their home.

It sounds like this could be challenging if you live in a country with lower levels of infrastructure.

Response time on identity verification cases seems to vary from a few weeks to several months, with users’ money stuck in their account until that time.

If I were starting an online store and couldn’t get paid for months on end, I’d be pretty upset too.

What about encryption?

This is where Skrill really shines. In terms of being hacker-proof, Skrill is slightly better than the competition.

Skrill use 128-bit encryption, and requires users to utilize 2-factor authentication whenever they log in to the site. (Click to Tweet)

Also read:

Before wrapping up, let’s look at some other reasons you should use Skrill.

7 The Jaw Dropping Facts Known By Very Few

You might be thinking, Given everything I’ve written, it might sound like there’s no reason to use Skrill unless you’re a masochist? Not at all! Keep reading.

I think it would be a shame to put out a Skrill review without talking about why someone might want to use their service. To be as fair as possible, I’m also going to tell you everything good I learned about Skrill.

#1 They Do Business Where Other Internet Payment Processors Won’t

If you’re trying to business with someone in a politically unstable area – or you live in one yourself – Skrill may be your only option for doing business online.

As I’ve already mentioned, Skrill does business in a lot of developing countries where more mainstream payment processors simply refuse to do business.

They accept payments to and from literally every country on the planet that isn’t being sanctioned by the UN or the World Bank.

#2 Business In Industries Other Processors Won’t Touch

What if you’re looking to buy or sell services that PayPal and others don’t support?

I’ve talked about how Skrill started out as a gambling payment processor. While they’ve expanded their business since then, they still specialize in dealing with riskier businesses.

This is one reason why their fees are higher than the competition; they’re more vulnerable to losses.

In addition to gambling, Skrill also processes payments for pornographic content and firearms. These are industries that most online payment processors won’t touch with a 10-foot pole.

Once again, if you’re doing this kind of business, you may find that Skrill is the only company willing to work with you.

#3 Variety Of Payment Methods

What currencies can you use on Skrill?

I’ve complained about Skrill’s currency exchange fees, but what I didn’t mention is that Skrill currently accepts over 40 world currencies, as opposed to PayPal’s 20.

You can also use Bitcoin, Bitcoin Cash, Ether, Etherium Classic, XRP, Ox or Litecoin, Chainlink, AVAX, Solana, and many others.

If you’re using US dollars or other Western currencies, this probably won’t make a difference to you. But if you do business on a truly global scale and work with cryptocurrency, Skrill beats the competition by a mile.

#4 Support Transactions For Apps

If you’re an app developer, you’ll love Skrill.

Unlike most competitors, Skrill allows you to accept micro transactions from apps.

This is extremely popular for gambling apps in particular, but can also be used for games, business apps, or any other app you’re developing.

This is a great way to accept mobile payments from users who don’t have Skrill but do have your app.

#5 Seamless Integration With Online Retailers

If you’re running an online store on a third-party platform, Skrill is a payment option on many of them.

ShopFactory, Shopify, Magneto, WooCommerce, Wifeo and hundreds of other websites partner with Skrill so their sellers can accept payments.

Looking to start an Ecommerce Store? Read this!

This is yet another way to accept payments from customers who don’t personally have Skrill accounts.

#6 One-Click Checkout

How convenient is Skrill for your customers? As convenient as pushing a button.

A lot of online payment processors have this feature, but I’ve listed it anyway because it’s a huge convenience for your customers. Anyone who uses the Skrill wallet can send payments with the touch of a button.

In today’s fast-paced world, this kind of efficiency is essential for retaining customers.

#7 Recurring Payments

Another good thing about Skrill is that they support recurring payments.

No, the phone company or the power company won’t accept your payments through Skrill. Gambling sites will, though, as will a lot of adult websites.

Most payment services support recurring payments, but nobody else will let you work with these kinds of businesses to begin with.

Mass Payments

If you regularly send out mass payments, Skrill is extremely convenient.

Suppose you need to send several identical payments to different people. They may be contractors, employees or vendors.

You can either send several payments individually, or you can use Skrill to send a whole batch of payments at once.

How Does a Skrill Prepaid Card Work?

If you want to use your Skrill account to make in-person purchases, it’s easy to do with a Skrill debit card.

Skrill debit cards are tied directly to your Skrill account, so you can instantly access any money in your account by using your card, without waiting for a transfer.

This is an improvement over PayPal, which requires you to transfer money from your regular PayPal account to your PayPal debit card.

PayPal also only offers service to US customers, while Skrill debit cards are available in four currencies: US dollars, British pounds, Euros, and the Polish Zloty.

If your outside of those currency zones, you’ll still be out of luck, but that’s still a lot more flexibility than PayPal offers.

There are no transaction fees for using a Skrill debit card, including for paying bills. If you rarely use cash, you can use your Skrill card for everyday purchases without paying the $5.69 withdrawal fee.

That said, for ATM withdrawals, Skrill is expensive. They charge a $2.40 fee for withdrawals. They also charge a €10 ($11.34) annual fee for debit account maintenance.

Frequently Asked Questions

Is Skrill secure?

Skrill has to comply with US, UK, and EU financial regulations so they have very strict standards for identity verification. Skrill also uses 128-bit encryption and required users to utilize 2-factor authentication whenever they log in to the site.

Is Skrill safer than PayPal?

Their security policies are stronger than PayPal’s.

What countries can use Skrill?

Every country can use Skrill, except countries that have been sanctioned by the World Bank, or the UN.

How much does Skrill charge to withdraw?

ATM withdrawals: they charge up to 3.99%

Is Skrill illegal?

Skrill is a completely legal and secure platform that supports 40 different currencies.

Is Skrill deposit safe?

Depositing money in Skrill is safe because its rules and regulations are stricter than various other similar companies like PayPal.

Can I get my money back from Skrill?

Generally, Skrill does not support refunds from the merchants. Therefore, users have to use the same Skrill account to withdraw the funds. However, in some cases, users might be able to get money back from Skrill by contacting its representative and requesting a refund.

Wrapping Up

I was hoping to answer the question “is Skrill safe?” with a simple yes or no. I’ll bet you were also expecting a simple answer.

However, It depends on what that question means.

If it means “Is my Skrill payment secure,” the answer is yes. Their security policies are stronger that most payment processors, including PayPal.

If it means “Is Skrill a merchant services scam?” the answer is no. They’re a legitimate corporation that abides by all the same regulations PayPal and other online payment processor have to follow.

If it means “Am I safe from Skrill scams?” it depends on who you’re dealing with. Like with any other payment processor, most merchants and customers are good people trying to do honest business. And then there are a handful who aren’t.

Skrill isn’t the best payment processor out there. They charge high fees and their ID verification process can be challenging if your country’s infrastructure is poor.

On the other hand, they’re the only company who services many companies and industries. If you need to do business in these areas, Skrill is a secure service that will get the job done.

Creating an account is quick and easy, so why not give them a shot?

Sign up Skrill for free and create account. It takes just a few minutes to create a Skrill wallet and bring all your payment details together in one place.

What’s your experience with Skrill? Leave a comment below and let us know.

Update: Based on ever-increasing complaints against Skrill, we highly recommend you to switch to TransferWise (now Wise)

I couldn't log in to my account and be continuously asked to change my password, but when I do, it still asks me the same thing over and over. I asked them for assistance on many occasions but no help. I have no idea what happened with my money. There is no support from Skrill at all, so be careful and avoid them. When I finally managed to log in to my account, but I am restricted with any transactions. My money is still locked, and I lost a thousand US dollar last week due to inability to use my funds. I talked to them twice, and all I got is "we are working on your case". Worth mentioning that I am trying to resolve my issues with the Skrill account for more than a month. I will appreciate it if there is anybody out there to advise how to use this site.

Skrill USA, Inc., stated in a February 28 email to me that the transfer would be cancelled and that amount would be refunded to my bank account. On March 4, Skrill’s Nick confirmed that the transaction had been cancelled and the funds were still in the U.S. On March 12, I received another email from Skrill, which reiterated: “Your money transfer to BIKKAM BASHK has failed. Your deposit will be refunded.” (Transaction 35778369102).It further stated in a footnote that the remedy would be a refund of the transaction amount. By March 30, however, Skrill still had not issued the refund, so I called again and was told to expect a response by email. Without any legal basis or explanation, Skrill USA, Inc., attempted to misappropriate my funds, although it had a fiduciary responsibility to return to me. In a April 5, 2021, email, it advised me that my account had been closed and that it had “... applied an administrative fee for the amount of $500 leaving your balance to be 0 USD.” It added: “Please be advised that this decision is final and irreversible.” I vowed, however, to pursue all of the administrative, regulatory, and legal remedies available to me. Only after I complained to the Consumer Financial Protection Bureau did Skrill repay me. Other federal and state agencies should investigate Skrill for attempted fraud.

I transfer more than 81000 India rupees in Thailand bank account but all transection are pending and contact survice not replying please help me

Absolutely #scam. They steal money from you don't find or use

I have had the worst experience ever in my life with this app they will take your money in an instant but when u want to withdraw or transfer they give every excuse under the sun to not let you transfer or withdraw your funds, absolute scam and can't believe Google playstore has them on thier platform.. they are a scam operating saying there is verification problem and they are processing your documents. It takes weekes toget a 5 min verification done.. I gave up and resigned to the thought I was scammed.. thanks Google playstore for promoting this scaming app.

I can't recommend it to anyone because it's not reliable. I was still registering my account and submitting my documents documents with my personal address and still waiting for verification might you I already deposited my money to that account but now I can't access it since it says my account is permanently closed when I try to log in.

I've been playing on this app that uses skrill for a long time now. All of a sudden they are having problems with purchases going through. I spoke to customer service. They suggested using skrill while they try to fix the problem. So I registered an account. But I can't get to the part where I add funds because they require my bank password which I'm not going to give out. Everything i have read says they don't ask for it but they do. I'm confused and irritated and still not giving up my password.

Today 2/24/21 , I wanted to use SKRILL first time because I thought their exchange rate was good for Indian rupees . My transaction failed but the worst part was the failed customer service at Skrill. Now I know why they give you better rate at 0 customer service. I will never recommend Skrill to anyone. I've been trying to find out what was the status of my transaction, there's no way you could find that out. I'm not even sure if they will take the money out from my debit card later . What a chaotic situation with this company. I can never trust this company. What a mistake. My first time experience with Skrill was very negative and I feel if this company could ever be trusted .

Skrill is part of the (Paysafe Group) and it is an online bank that allows you to transfer your money from your portfolio to individual or company portfolios and this bank is considered a British founded in 2001 was its beginning in online gambling games recently (Moneybookers), but this site was transferred to An Online bank that allows you to receive and transfer money online quickly and easily, and now let’s know more about what is Skrill

They are stealing People's Money! They did not complete my withdrawal in two months saying that they are experiencing problems with Turkish banks. When I asked them what can I do, they said it's better that I send the money in my account to another skrill user. My cousin opened a skrill account in England but before they verify his account they took the money in my account. And after verifying his account they did not transfer the money. So the money is lost now. If they do not solve this asap, I'll write everywhere that they are stealing money from people and start a social media campaign against them.

Skrill is stealing people's money! They did not complete my withdrawal in two months saying that they are experiencing problems with Turkish banks. When I asked them what can I do, they said it's better that I send the money in my account to another skrill user. My cousin opened a skrill account in England but before they verify his account they took the money in my account. And after verifying his account they did not transfer the money. So the money is lost now. If they do not solve this asap, I'll write everywhere that they are stealing money from people and start a social media campaign against them.

Iam new to skrill so I need helping Iam jobless Can get here profits I need more information to the company I live in Somalia

Skrill is a complete SCAM do not believe this article look at the reviews on the App Store

Skrill is scam. I initiated withdrawal from my skrill account to my bank account. It's been 2 months and it hasnt arrived in my bank account. Customer Service wont reply. Skrill stole my money and thousands of other Turkish clients. Skrill will no longer operate in Turkey and they dont send Turkish account holders' money. They closed our accounts and kept our money for themselves. BIG SCAM!!!

Skrill is awful. Do not use. The withdrawal has taken 16 days so far. The customer service is so bad, They just say " passing it on to relevant team' Do not click this affiliate link post here. Skrill are so bad do not use them find another online merchant

Srill is Totally a BIG SCAM! Immediately shut down my account without explanation or warning and got all my money. Please don't fall for this! You have been warned!!!

Skrill has become the waste nightmare of my life. Its closer to 2 months now while they are holding on to my money. My bank returned 3 transactions i made back to skrill. 2 transactions with the smallest figire were returned withing a week while the other transaction with the highest figure couldn't till date. When i called skrill they asked for proof of my identification and i provided and they just went quiet on me. I made another follow up and they requested for the proof of returned funds from my bank and i still provided them with it. Now they even close each case i open without my concern. What a bad financial company it is. I hate skrill with all my heart.

Skrill is a scam, never deposit your money. Don't say I didn't warn you.

I've the same situation that is often reported here. My account was restricted without any explanations. This is simple a robery. Most of people that post here a comment, just for bad reasons. If they are regulated by FCA (now with Brexit don't know how it works) better to make a big complain to them, envolving as much people as possible. For what I've seen in various sites, this is a common situation. If I saw it before, never would open an account with them. It takes times and little more expensive, but the traditional wire transfer is much more safe...

If it's not a scam then why are you not taking every chance to solve every issue and problem with your clients... A simple call from your company is just an indicator that your company is LEGIT.... Lets get REAL.... Maybe every country has its different laws on e-commerce but there is always TIME for your company....Goodluck on the things to come

I had the worst experience with skrill. When they received money in my account, they restricted it and asked for identification details. After sending them, they closed the account and blocked my IP address. Further, they utilised the whole €150 euros in the account as administration fees. I think this is immoral, unjust and unethical business practise!

Worst service error !!!!!!!!!!!! Do not try to withdraw funds from Skrill. I have been battling for three months now and numerous unsuccessful attempts. Whatever bank or account you provide gets rejected of failed . I have tried to contact them but no luck. Cannot recommend these guys to my worst enemy !!!

Hello everyone, My name is Yakov, My account has been restricted for more than 7 months, and no one explains the reason?! I have a VIP account for more than 3-4 years. I did everything that was requested by email ( changed email and password, sent my passport copy) but my account still has restrictions and no one can give me any update when they will remove the restrictions and why does it take so long. Their service is terrible! They have never contacted me on their initiative, they have never been the first to write to me about the status of my account. In 7 months they have never provided me with an answer or update why restrictions were imposed on my account and when they will be removed. I called them many times, spent my money on international calls, and never received any answer about the reason for the restrictions. They ruined my family, our financial situation is dire. Who can help me in this situation?

danger/warning. skrill cancel cards for no reason not only me They sent me an email that had requested the cancellation of the card "FRAUD / FALSE" I asked them and they responded in a mocking way. We had sent you an e-mail and since we did not receive any updates from you, we consider that the problem is already solved. 1) I was never contacted 2) I only received an email that my card had been canceled. Danger! people I recommend you spend money before they do the same to you.

is skrill card traceable by bank? and do i need to pay tax of the funds that i get in my account?

I tried the first international transfer

First and last time i use skrill. Send inn $500, skrill changes to Nkr and take a fee. Then on the withdraw skrill changes it to € and take a fee. Now may bank must changes it no Nkr and they take a fee to.

I just got a ding from my bank that 4 transactions have come out of my account I did not do this And this money better be debited back to my account today I don’t even know what this is have not ordered anything or want my money moved please put back in my account t

I want to make a withdrawal to my Nedbank account and it does not want to accept my Swift code, which I confirmed with my bank as correct. It also does not accept Mastercard withdrawal, after I paid with a Mastercard. I will continue expressing my bad experience on every platform. I have already informed my friends, contacts, family about this.

Worst payment system ever, now I can't even get through to support. When sending a question ticket on contact us it automatically writes *ticket closed* I have now been unable to withdraw money from skrill for about two months, a day after withdrawal it reflects back to Skrill account and no one wants to explain

Go to TrustPilot and look at the negative reviews. About 17% of Skrill clients have reported that their accounts have been suspended and balances emptied. Be very careful placing funds into Skrill. If it happens to you rather than just complain go to financial authorities and report them. It's a scandal that they are doing to people. It will blow-back against them in a big way. The above article was made in good faith, however, nearly a quarter of Skrill users have had balances emptied.

Thanks for the information. But i still have questions. Cos one of my friend send me money from usa. He asking me to deposit first my money from gcash to bitcoin then i will send it here on skrill. But its sounds like confusing to me because he wanted me to deposit first a 50USD just to receive the money he send. Is this true? Thank you

I should say this is the first website I've seen skrill getting a 5star rating. It's the worst ewallet of all. Funds hang, holds and refusal to process certain transactions. Did you know that you can't use funds deposited through MasterCard for online payments? Neither can you return them to their original source MasterCard? I'm not sure if your research was done on the same internet as I have access to.

what about this [user posted a video which has been moderated]

First of all I want to say great blog! I had a quick question that I'd like to ask if you do not mind. I was curious to know how you center yourself and clear your head prior to writing. I have had a difficult time clearing my thoughts in getting my ideas out there. I truly do take pleasure in writing but it just seems like the first 10 to 15 minutes are lost simply just trying to figure out how to begin. Any recommendations or hints? Thanks!

Woah! I'm really digging the template/theme of this site. It's simple, yet effective. A lot off times it's difficult to get that "perfect balance" between usability aand appearance. I must say you've done a superb jobb with this. In addition, the blog loads very quick for me on Firefox. Superb Blog!

Great Read very insightful thank you to the writers on this piece